Image credit: East Asia Forum

Small and medium enterprises (SMEs) are suffering greatly due to the Covid-19 pandemic.

Between January and May 2020, 26% of SMEs worldwide closed down permanently, with South Asia as the hardest hit at 46%. 61% of them reported reduced sales.

The wider effects on society are not negligible – SMEs make up 98% of businesses and provide 50% of the employment in the Asia-Pacific Region.

For those who managed to survive, the ordeal is far from over as they remained fragile and lack sufficient cash reserves to survive.

Liquidity deterioration, a lack of skilled labour, and issues in adopting technological solutions are just some of the challenges faced by SMEs throughout the pandemic.

SMEs are unsung heroes, making up more than 90% of total business establishments in both Malaysia and China. According to the Department of Statistics, SMEs contributed 38.2% of Malaysia's GDP, and 48.0% of national employment as of 2020.

However, due to the pandemic, they have been hard hit by both demand and supply shocks. Furthermore, small firms are more vulnerable to economic shocks compared to larger firms. Similarly, non- exporters fare worse than exporters in the face of the pandemic.

Post-pandemic, many SMEs have been dealing with cash flow crunches. With their savings depleted, many SMEs are unable to recruit, reverse employee pay cuts, or even pay for rawmaterial to resume operations.

Instead, diminished Malaysian SMEs have had to take a deep cut by letting go of comparatively cheap human labour. By accelerating automation and reducing reliance on manpower, SMEs have been forced to evolve into the next generation of entrepreneurs.

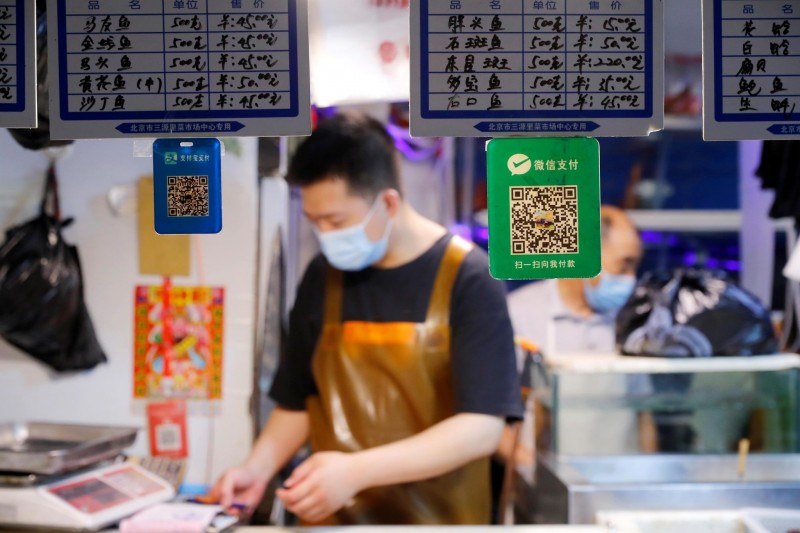

To help Malaysian SMEs overcome and survive the challenges, the Malaysian government has introduced the SME Digitalisation Grant. This provides eligible SMEs with RM2,000 toadopt e-commerce, online marketing, and digital payments.

Under the 2022 Budget, the SME Digitalization Grant Scheme was further enhanced – total funds are increased to RM200 million, with RM50 million earmarked for rural bumiputra micro-entrepreneurs.

Furthermore, under the Prihatin stimulus package, the government has provided a moratorium on loans, as well as a Covid-19 special relief fund (SRF) for SMEs, where RM50 billion is allocated to provide loan guarantee facilities for all SMEs.

What China has done for SMEs, and how Malaysia can learn from it

Numbering above 38 million, Chinese SMEs play a greater role in the Chinese economy, contributing 60% of industrial output and 80% of employment. With five million new SMEs every year, Chinese SMEs are projected to grow at a rate of 10% year-over-year.

In the face of the pandemic, the Chinese government has been generous in tax cuts and other financial support for SMEs. Beijing implemented tax cuts last year to provide fiscal space in operational expenses for SMEs.

In April, the government raised the monthly threshold for value-added tax on sales of 100,000 yuan (US$15,600) to 150,000 yuan. In October, Beijing said it would defer 3 months of tax payments for SMEs in the manufacturing sector. The Chinese government also waived the contributions of workers to social and endowment insurance.

Financial support for SMEs also included extensions for credit and interest repayments, in addition to credit support for smaller businesses. These measures make it easier for SMEs to secure loans, which used to be difficult for SMEs, owing to the inability to provide mortgage guarantees.

How the BRI helps SMEs

Crucially, the broad-based growth and new trade opportunities brought about by the Belt and Road Initiative can be harnessed by SMEs to fuel their growth. Given the significance of SMEs to both the Malaysian and Chinese economies, it is vital that SMEs gain greater awareness of the opportunities provided by the BRI. Furthermore, competitiveness and access to international markets available to SMEs will ensure gains from trade are shared widely across society.

It may be beneficial for Malaysia to emulate the sectoral make-up of Chinese SMEs – 94% of them are into manufacturing. Conversely, SMEs in Malaysia are primarily service-oriented (89% of total SMEs). It is recognized that the manufacturing sector provides a greater spillover effect to the economy, both in the short and long run.

Therefore, the Malaysian government should implement long-term policies and incentives to help shift Malaysian SMEs into manufacturing.

Furthermore, banks and the financial sector should offer much-needed expert advice and special transfer facilities to assist SMEs, especially in ensuring capital investment between BRI countries is done effectively and efficiently to capitalize upon new opportunities.

Malaysia’s Leading Entrepreneur Accelerator Platform (LEAP) can play an important role preparing SMEs for commercialization through raising funds in the equity market. Similar programmes can be emulated in BRI countries as means to facilitate investment and the development of SMEs.

Multi-stakeholder partnerships can effectively boost the development of many city-based SME-driven industrial sectors. In this, the BRI is crucial in creating mutually-beneficial partnerships in many of the world's most populous developing economies.

The contributions of SMEs are not to be dismissed, and thus, effective SME policies to needed to create productive employment and decent jobs in the wider economy. Through regional cooperation, the BRI will play a strategic role in the international community, especially in empowering growth towards sustainable urban development through the development of SMEs.

Source: https://www.thestar.com.my/opinion/columnists/search-scholar-series/2022/05/30/the-contribution-of-smes-in-malaysia-and-china